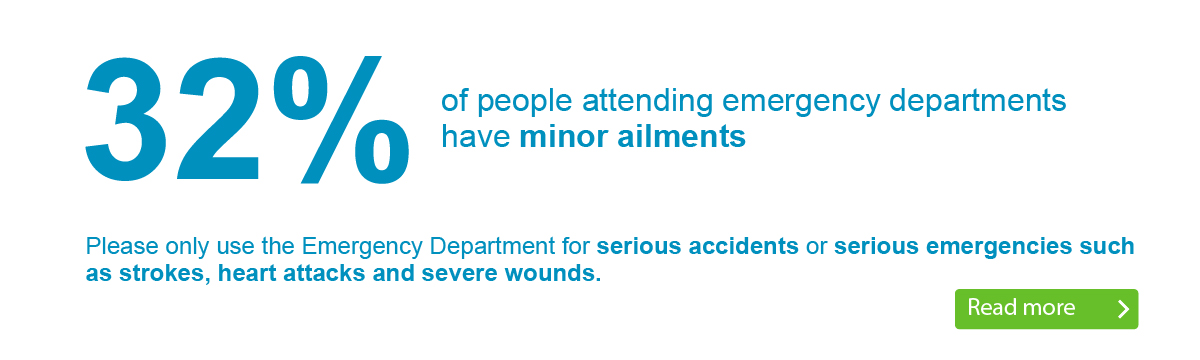

Our A&Es are extremely busy.

Are you accessing the right urgent care service for your needs?

Visiting Hospital

As a patient or visitor, you’ll find links to all the information you need about visiting, our services, directions and contact details for our sites.

Gartnavel General Hospital

Vale of Leven Hospital

But everyone else was incredible, too.”

Royal Alexandra Hospital

Royal Alexandra Hospital

Queen Elizabeth University Hospital

Royal Hospital for Children

Inverclyde Royal Hospital

New Victoria Hospital

New Victoria Hospital

Royal Alexandra Hospital

Queen Elizabeth University Hospital

Gartnavel General Hospital

“Just some words of praise for the staff of ward 8a at the QEUH. My mother had a two-week stay. Excellent care from the domestic, catering, health care assistants, physio & OTs and of course the nurses. A special mention to the senior charge nurse Lauren, who is a credit to the professional. Well done and thank you very much!”

Queen Elizabeth University Hospital, Glasgow

New Victoria Hospital, Glasgow

“I’d like to thank the staff on ward 1a for their excellent care for my daughter who attended for surgery on her ear. They took time with her to answer any questions she had, helped her cope with pre-surgery procedures and ensured she wasn’t in pain throughout her stay. . I can’t thank them enough for their care for her.

Royal Hospital for Children, Glasgow

Royal Alexandra Hospital, Paisley

“I would like to heap as much praise as possible on Dr Hogan (of Dr’s Hogan, Allen & Quinn) at Greenock Health Centre. I haven’t seen her for many months, if not years, but what a refreshing change to visit the department and speak to someone so positive, happy, bright and cheerful.”

Greenock Health Centre, Inverclyde

“Thank you for my CPN session this morning. The lady was superbly knowledgeable and kind. I felt a huge burden being lifted with every passing minute. What a professional! What perception! What rare empathy! Thank you Charleston Centre! “

Renfrewshire Community Adult Mental Health

“I recently received treatment from the Alderman Road Dental Practice. So impressed. The dentist and dental nurse put me at my ease, were very professional and did an outstanding job. The same goes for the guys in Reception. Well done to all concerned.”

Community Dental Service

“My son who is 7 and has autism recently attended day surgery at area 1b and ward 1a his care from the staff from start to finish was amazing it was a true example of the NHS at its best. The nurses in ward 1a were just wonderful. A very stressful and scary time for our wee boy turned out to be relaxed and problem free thanks to the wonderful staff.

Dr Alison Cairns was his consultant.”

Royal Hospital for Children, Glasgow

Committed caring team.”

Inverclyde Royal Hospital. Greenock

Glasgow Royal Infirmary, Glasgow

Royal Alexandra Hospital, Paisley

Queen Elizabeth University Hospital, Glasgow

Glasgow Royal Infirmary

New Victoria Hospital, Glasgow

“From the moment I arrived today (3.45pm 3rd Nov 2021) the staff were outstanding. The security staff were friendly and the staff guiding you to depts were so helpful and polite. I was attending for an ultrasound scan and both staff members were exceptional. They put me at ease and were kind and thoughtful throughput the procedure. Didn’t get full names but one was called Wendy. Really impressed!”

Queen Elizabeth University Hospital, Glasgow

“I underwent a colonoscopy exam this morning and the treatment I received from reception to the staff who performed my procedure was truly marvellous. All the staff who looked after me were professional, caring and very understanding. They helped me through an anxious experience this morning. Very many thanks to a superb team of professionals!”

Inverclyde Royal Hospital. Greenock

Queen Elizabeth University Hospital, Glasgow

Glasgow Royal Infirmary, Glasgow

“I was recently admitted to the GYN ward. Being new to Glasgow having relocated from London it was an anxious time, but all the staff on ward 56A were lovely and so kind and compassionate. I am a nurse myself and it really made the world of difference when I suddenly had to take on the patient role. Thank you.”

Princess Royal Maternity, Glasgow Royal Infirmary

“Have been attending the hospital for 10 years after minor breast surgery. The staff in mammography, imaging and the consultants involved in my care have been absolutely outstanding in terms of their clinical care and professionalism. These members of staff represent everything that is good about our NHS. Sincere thanks from a very grateful patient.”

New Victoria Hospital, Glasgow

Thank you very much.”

Lightburn Hospital, Glasgow

“Eye Clinic – I was seen last Friday regarding a sports injury to my eye. Excellent treatment and diagnosis by staff. Referred to Gartnavel for further treatment that evening. Seen the following day and back at RAH for further check-up. I cannot praise the nursing and medical staff highly enough. They are truly dedicated to their profession .”

Royal Alexandra Hospital, Paisley

“I ‘d like to congratulate and thank all involved im my treatment when I attended Emergency at IRH after a fall. The service was great, from reception doctor consultant, X-ray, nurses and porters. All in all I was in and out with broken ankle diagnosed big boot fitted and pain meds administered within 3 hours. Everything explained. Staff were so helpful and professional. Well done!

Inverclyde Royal Hospital. Greenock

Vale of Leven Hospital

Queen Elizabeth University Hospital, Glasgow

“My son who is 7 and has autism recently attended day surgery at area 1b and ward 1a his care from the staff from start to finish was amazing it was a true example of the NHS at its best. The nurses in ward 1a were just wonderful. A very stressful and scary time for our wee boy turned out to be relaxed and problem free thanks to the wonderful staff. Dr Alison Cairns was his consultant.”

Royal Hospital for Children, Glasgow

Truly 10/10.” 👏👏👏👏👏

Gartnavel General Hospital, Glasgow

Vale of Leven Hospital, West Dunbartonshire

New Stobhill Hospital, Glasgow

Royal Alexandra Hospital, Paisley

Royal Hospital for Children, Glasgow

“Just to express my extreme delight at the whole experience from visiting my GP at Barclay Maryhill to my breast screening and follow up at the breast clinic. All completed within 10 days of seeing my GP. Staff were wonderful and so professional and kind. Thank you so much for a fabulous service. I send my support and admiration to all health service workers. Couldn’t be bettered! “

Gartnavel General Hospital, Glasgow

Royal Alexandra Hospital, Paisley

Queen Elizabeth University Hospital, Glasgow

/ X-ray dept and the Fracture Clinic. Every member of staff were not only professional and caring, but also seemed “upbeat” and incredibly enthusiastic about what they do for those of us who occasionally rely upon the hospital. Great sense of humour too! Thank you all so much.”

Vale of Leven Hospital

Queen Elizabeth University Hospital, Glasgow

Royal Hospital for Children, Glasgow

New Victoria Hospital, Glasgow

Vale of Leven Hospital